This post may contain affiliate links, please read our disclosure policy – Designed by Freepik.

We live in a world where debt isn’t just common—it’s expected.

With credit readily available and relentless marketing pushing us to spend, it’s no surprise that over 41% of Americans are in debt. And this number continues to climb.

If you’re reading this, it means you’ve had an eye-opening moment and are ready to tackle your debt once and for all.

It can seem daunting to pay off debt when you factor in car payments, medical bills, or a mortgage, especially without a sudden financial windfall. However, even with limited resources, there are strategies to help you get out of debt.

This post is all about how to become debt free and reignite joy in life.

Spending money on credit card is easy (and let’s admit it – FUN)

And then, before you know it, those minimum payments start to spiral out of control. The stress weighs heavily on your life and impacts those around you.

Yet, nobody openly discusses the struggle of getting out of debt.

Society tempts us with the idea of acquiring what we want NOW and forgetting about repayment for the moment.

This is why Americans are burdened with $17.5 trillion in consumer debt!

Isn’t it time to regain control over your finances and your life?

It requires effort, time, and real dedication. It won’t be easy, but you can achieve it!

So don’t worry, my friend. IT WILL END!

Here are 11 essential steps to help you get out of debt quickly:

The Surefire Steps To Become Debt Free

1. Stop adding to your existing debt

Designed by Freepik

Consider cutting out unnecessary expenses such as Netflix subscriptions, expensive dining, or extra clothes and shoes you don’t need.

Credit cards can make your spending money feel like it’s disappearing.

Even though cashback or rewards credit cards seem tempting, if you’re already in debt, managing your money effectively is crucial. Avoid:

- Using credit cards to cover expenses

- Taking out high-interest loans

- Getting advances on your paychecks

- Transferring balances with 0% offers

- Borrowing from friends and family

This step might be the toughest because it forces you to closely examine your spending habits.

But it’s a vital starting point; otherwise, regaining control over your debt will be even harder.

2. Embrace frugality

Living frugally can free up extra funds in your budget, which you can then use to pay off your debt more rapidly.

To escape debt, employ various frugality tips to conserve additional cash and accelerate debt repayment.

Reducing living expenses is a practical approach to achieve this.

Here are some proven ways to save money:

- Always turn off lights

- Cook meals from scratch

- Pack your lunch for work

- Skip visits to coffee shops

- Enjoy meals for $2 a day

- Buy discounted food close to expiry

- Eat at home more often

You can check out a full list of 86 extreme frugality tips so you can be sure you will save hundreds of dollars every month to pay off your debt.

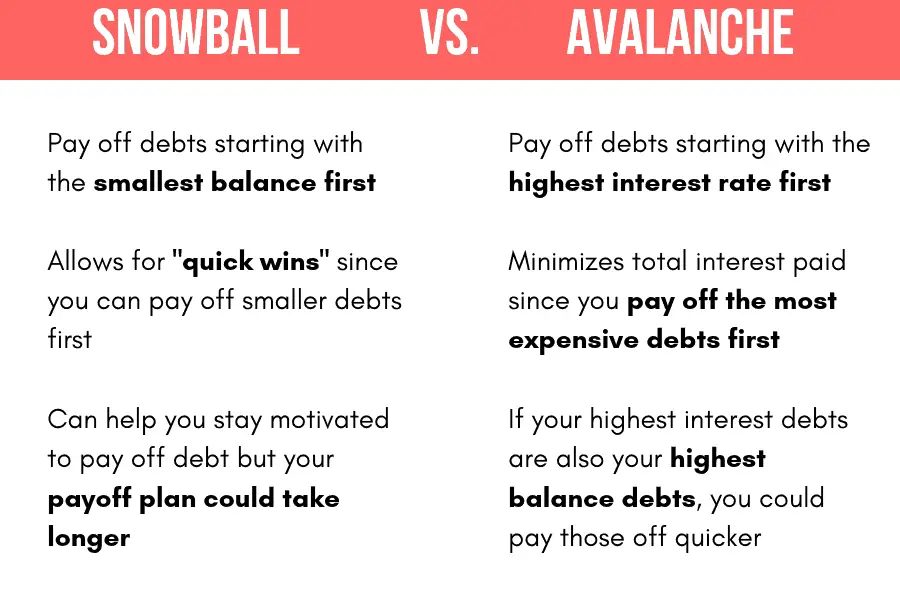

3. Crush Debt with the Snowball or Avalanche Method

Image by Boss Single Mama

Managing debt can feel daunting, but having the right strategy can simplify the process.

One popular method is the snowball technique, introduced by financial expert Dave Ramsey. This approach involves focusing on your smallest debt first. Once that debt is paid off, you transfer the payment amount to the next smallest debt and continue this pattern until all debts are cleared.

This method is effective because it builds momentum and motivation through early wins with smaller debts, setting you up for tackling larger ones.

Alternatively, the avalanche method prioritizes debts with the highest interest rates. You start by paying off the debt with the highest APR and proceed to the next highest rate.

Both the snowball and avalanche methods can be powerful tools in your debt repayment plan.

4. Establish a Small Emergency Fund

Maintaining an emergency fund is crucial even while working on debt repayment.

Having an emergency fund ensures that unexpected expenses don’t lead to additional debt. Instead of relying on credit cards for unforeseen costs, you’ll use your emergency savings.

The goal is to escape debt, not to stay in it.

In the event of an emergency, draw from your emergency fund rather than resorting to credit.

If your annual income is under $20,000, a $500 emergency fund should suffice. For those earning more than $20,000, consider setting aside $1,000 for emergencies.

Paying yourself first is a crucial step not just for getting out of debt, but also for staying debt-free over time.

Once you have a comfortable savings cushion, you can focus entirely on paying down your debt.

5. Prioritize Your Health

Becoming overly focused on work won’t accelerate your debt repayment and may actually increase your risk of stress-related health issues.

Maintaining a balanced diet and exercising regularly can help prevent future health problems, saving you money on medical costs and contributing to a longer, healthier life.

Taking care of your health is vital, even while dealing with debt. Without good health, saving money and ensuring your long-term well-being becomes challenging.

6. Explore Additional Income Streams

While there’s a limit to how much you can save, there’s no limit to how much you can earn!

Here are some ways to increase your income:

- Request additional hours at work if you’re an hourly employee

- Complete paid surveys online

- Take on a part-time job in addition to your full-time job

- Negotiate a salary increase if you’re a salaried employee

- Start an online job as a stay-at-home mom

Earning extra money on the side will significantly support your journey to becoming debt-free.

For example, if you make an extra $100 this month, that’s $100 more you can put toward your debt.

Remember to be patient and maintain a balanced approach to work and life as you work toward eliminating debt.

7. Create a Budget

A budget helps you allocate every dollar to its intended use.

Budgeting lets you track your spending and plan for future expenses such as vacations, weddings, or emergencies.

A well-planned budget helps you:

- Identify areas where you may be overspending

- Determine how much you can realistically afford to pay toward debt

Both are essential for managing debt effectively, especially when living paycheck to paycheck.

I personally use the You Need A Budget method, which clarifies your financial priorities and simplifies your budgeting process.

Tip: Budgets might not be perfect every month due to unexpected expenses, so adjust as needed!

8. Modify Your Spending Habits

Understanding the difference between your actual spending and your planned spending is crucial for changing your money habits.

You need to commit to altering your behavior to overcome debt.

Often, it’s the small, everyday expenses that derail your progress, such as:

- Shopping online out of boredom

- Forgetting about subscriptions after signing up

- Giving in to unplanned impulse purchases

- Failing to plan meals and opting for takeout instead

Maintaining the same lifestyle that led to debt won’t help you get out of it.

I’ve put together an in-depth article on this subject. If you’re determined to manage debt while living paycheck to paycheck, explore this list of 7 money habits.

9. Negotiate Your Interest Rates

High interest rates can hinder your efforts to pay down debt when living paycheck to paycheck, as less of your payment goes toward the principal.

Consider these strategies to lower your interest rates:

- Contact your credit card issuer and request a lower rate

- Apply for a low-interest personal loan to consolidate your debts

- Transfer balances to a new credit card offering 0% APR

It’s worth calling your credit card company to negotiate better terms, including lower interest rates and more manageable monthly payments.

If your initial call doesn’t yield results, don’t be discouraged. Try again—your persistence could save you hundreds or even thousands of dollars!

10. Celebrate Your Small Victories

Recognizing and celebrating small victories is crucial in your journey to becoming debt-free. Yes, you can make debt repayment enjoyable!

Did you pay off your first debt? Celebrate it.

Cleared your first $1,000? Celebrate that too.

Celebration doesn’t mean splurging. Opt for low-cost or free rewards, such as preparing a special meal at home or enjoying a picnic in the park.

11. Appreciate Free Joys

Designed by Freepik

It might sound cliché, but it’s true—the best things in life are free.

A heartfelt hug, laughter with friends, or a walk through colorful autumn leaves are priceless and deeply fulfilling.

Seek out these free joys that bring you happiness.

Final Thoughts on Becoming Debt-Free

Escaping debt on a tight budget may seem daunting, but it’s achievable.

These tips can help you develop a solid plan to eliminate debt, allowing you to save more money.

Patience is key, as results take time. Success comes from implementing effective strategies.

Debt-free individuals exercise self-discipline. They don’t chase trends or seek to impress others with material possessions.

Focus on managing your money wisely. If you plan to vacation, go for it—but budget carefully to understand its impact on your progress.

Are you debt-free? Share your tips and experiences in the comments below.

I hope this article inspires and motivates you on your journey to financial freedom.

This post was all about how to become debt free fast. Don’t forget to pin it and follow me on Pinterest. Enjoy the rest of your day! 😊

Leave a Reply